The very best joint installment loans for negative credit are from Accomplish Own Loans, LendingClub and USAA. These lenders give aggressive charges, have credit rating needs below 640, and permit you to apply for installment loans by using a co-borrower. Incorporating a co-borrower on your loan software may possibly assistance to raise your possibilities of approval.

You may not feel cozy borrowing from NetCredit given its history with purchaser issues — but Ensure that you achieve out to relatives and buddies who could possibly have borrowed in the lender to get a extra entire picture of its companies.

Nonetheless, the desire expenditures are so superior that the costs can inevitably exceed the principal number of the loan. Consequently, some solutions aren’t in your very best curiosity. And with BalanceCredit’s significant-end APRs reaching 720%, a few of its loans are more expensive than the typical payday loan. Hence, it is best to only take into consideration BalanceCredit if your provide features an APR near the minimal-conclusion of your array.

Pleased Money won't demand late payment service fees, or early payoff penalties if you choose to pay off your credit card debt more quickly than you initially meant, but there is an origination fee based on your credit score and software.

Luckily, the options above assist you to acquire a reliable loan when nonetheless retaining your interest costs workable. Also, most of the options above present flexible lending conditions, reduced service fees, and zero prepayment penalties. In addition, you take advantage of a simple acceptance procedure, speedy entry to cash, very low annual profits demands, and sometimes zero loan origination costs.

The easiest loans to acquire approved are loans that don't demand a credit Examine for instance payday loans, pawnshop loans, click here automobile title loans, and personal loans without having credit Examine.

No origination or register cost: Most of the lenders on this list charge borrowers an upfront charge for processing your loan.

However qualifying for these two financial products can do the job equally, They're two differing types of credit. A personal loan is often a style of installment loan, and a private line of credit is a kind of revolving credit.

two. Overview loan offers and select the 1 you are able to find the money for. Once you post your details, NetCredit will provide you with distinct phrase choices. A shorter phrase size signifies bigger month to month payments — however, you'll help save far more in interest.

Should you’re nevertheless not persuaded, check out the testimony critics gave to Congress concerning the hurt due to payday loans. Conversely, substitute loans are considerably more adaptable. With payday loans, once you drop driving on the payments, the substantial costs hold you from paying out off the principal and can send you spiraling right into a vicious financial debt cycle.

For additional advice on ideal installment loans for negative credit, WalletHub posed the next thoughts to some panel of industry experts. You are able to take a look at their bios and responses under. What information do you have for someone with undesirable credit who is seeking an installment loan?

A person past suggestion. Don’t get duped by payday lenders that masquerade as choice lenders. For the reason that difference between the two products is negligible, payday lenders will trick you into believing their product is better.

Engine by MoneyLion. CNBC Find does not Handle and isn't liable for third party procedures or methods, nor does CNBC Select have use of any facts you supply.

And you simply reward by acquiring a reduced APR, and the lender Added benefits since a cosigner decreases the default hazard. So, In case you have a dependable Buddy who’s willing to act as a cosigner, it is going to give your software a leg-up.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Joseph Mazzello Then & Now!

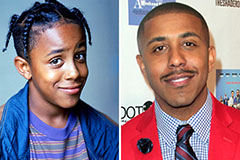

Joseph Mazzello Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!